How to Calculate Marketing ROI Beyond the Basics

- Jason Wojo

- Dec 13, 2025

- 16 min read

At its core, calculating marketing ROI is pretty simple: (Revenue - Marketing Cost) ÷ Marketing Cost. This formula is your starting point, turning campaign performance into a number that your finance team will actually understand. It's the language of business.

Your Foundation for Calculating Marketing ROI

Before you dive into complex attribution models and multi-channel mayhem, you have to get the basics right. Think of these core formulas as the essential building blocks for performance marketing. Without a solid grasp on them, you're just guessing—unable to justify your budget or prove the real value of your work.

Most marketers start with the simple, revenue-based ROI formula. It's clean, straightforward, and produces a clear percentage. Let's say you run a campaign that generates $200,000 in revenue from a $50,000 investment. Your ROI is a clean 300%. This direct approach is popular for a reason—it’s easy to calculate and explain.

But its simplicity is also its biggest flaw. This basic calculation can make marketing's contribution look way better than it actually is by ignoring crucial business costs and the long-term value of a customer. That's why we need to dig a little deeper.

Differentiating ROI from ROAS

It drives me crazy when marketers use Return on Investment (ROI) and Return on Ad Spend (ROAS) like they’re the same thing. They aren't. Confusing them can lead you to make some seriously bad strategic calls.

ROAS is a tactical metric. It tells you the gross revenue you got back for every dollar you spent on ads. It's perfect for checking the pulse of a specific Google Ads or Facebook Ads campaign.

ROI is a strategic metric. It measures the actual profit generated from your entire marketing investment after you subtract all the associated costs, not just what you paid for the ads.

Key Takeaway: Use ROAS for your day-to-day campaign optimization. Use ROI to figure out if your overall marketing efforts are actually making the business money. One tells you if your ads are efficient; the other tells you if your marketing is profitable.

For a more detailed breakdown of these foundational steps, this a comprehensive guide on calculating marketing ROI is a great resource.

Before we move on, let's put these formulas side-by-side to make the distinction crystal clear.

A Quick Guide to Core Marketing Return Formulas

Here’s a summary of the fundamental formulas for calculating marketing returns, including their primary use cases and key considerations.

Metric | Formula | Best Used For |

|---|---|---|

Basic ROI | (Revenue – Marketing Cost) ÷ Marketing Cost | High-level strategic assessment; understanding overall profitability. |

ROAS | Revenue ÷ Ad Spend | Tactical, in-platform campaign optimization; comparing ad channel efficiency. |

Gross Profit ROI | (Gross Profit – Marketing Cost) ÷ Marketing Cost | E-commerce or businesses with COGS; getting a more realistic profitability view. |

These simple tools are the first step, but as you can see, the basic ROI formula often isn't enough.

Moving to a More Accurate Formula

If you sell physical products or have significant fulfillment costs, the standard ROI formula is basically lying to you. It treats every dollar of revenue as pure profit, and we all know that’s not how business works.

A much more honest approach is the gross profit-based ROI formula.

This calculation refines things by subtracting the Cost of Goods Sold (COGS) from your revenue before you calculate the return. It's a small tweak that gives you a radically more accurate picture of profitability.

Gross Profit ROI Formula:(Gross Profit – Marketing Investment) ÷ Marketing Investment

Let’s run the numbers. An e-commerce brand spends $10,000 on a campaign that drives $50,000 in sales. The basic ROI looks fantastic at 400%. But what if the products they sold cost $25,000 to produce and ship? Your actual gross profit is only $25,000.

Now, let's use the better formula: .

This 150% ROI is a much more sober, realistic measure of the campaign's success. It shows your return after covering the cost of the actual items you sold. This simple change can stop you from pouring money into a campaign that looks profitable on the surface but is secretly burning cash. Mastering this distinction is your first real step toward building a truly data-driven marketing strategy.

Uncovering the True Cost of Your Marketing

If you're only plugging "ad spend" into the cost side of your ROI formula, you’re operating with a dangerously incomplete picture. It's a common mistake, I see it all the time, but it leads to inflated numbers that paint a rosy picture while your actual profitability suffers. To get ROI right, you have to account for every single dollar that went into acquiring that customer.

This total investment is what truly makes up your Customer Acquisition Cost (CAC). Just looking at the $10,000 you sent to Google ignores all the other resources that made that spend even possible, let alone effective. A real calculation has to be comprehensive, digging into all the expenses that are way too easy to overlook.

When you fail to include these costs, you're not just getting the math wrong—you're making major strategic decisions based on faulty data. Let's break down the hidden expenses you absolutely must start tracking.

Looking Beyond Ad Spend

Your ad budget is just the tip of the iceberg. A successful campaign is built on a much larger ecosystem of services, tools, and talent. Forgetting to factor these in is like calculating the cost of a new car by only looking at the price of its tires.

Here's a practical checklist of what your total marketing investment really includes:

Agency and Freelancer Fees: If you’re working with an agency like Wojo Media or hiring freelance copywriters, designers, or video editors, their retainers and project fees are direct campaign costs. No question.

Content Creation Expenses: This covers everything from a professional photoshoot and video production to the graphic designer you paid to whip up your ad creatives.

Software and Tools: Don't forget your martech stack. Subscriptions for your CRM, email marketing platform like Klaviyo, analytics software, and landing page builders like Unbounce are all part of the cost of doing business.

Prorated Team Salaries: The time your internal team spends on a campaign is a significant, and often ignored, expense. You need to calculate the prorated salaries and benefits for the marketing managers, content creators, and analysts involved.

As a rule of thumb, for every dollar of ad spend, there's often another $0.25 to $0.50 in associated operational costs. Overlooking this can mean your perceived 300% ROI is actually closer to 200%.

Factoring in these expenses gives you a far more accurate CAC. And that's absolutely essential for understanding if your business model is actually sustainable in the long run.

How Hidden Costs Reshape Your ROI

Let's walk through a real-world example to see how dramatically these "hidden" costs can flip your entire ROI figure on its head. Imagine you run an e-commerce brand and just launched a new social media campaign.

At first glance, the numbers look fantastic.

Ad Spend: $20,000

Revenue Generated: $100,000

Basic ROI:

A 400% ROI is something to celebrate, right? You might even be tempted to double down on this campaign based on that number alone. But hold on, let's uncover the true cost.

The Full Cost Breakdown

For this campaign, you had other expenses that were critical to its success.

Agency Management Fee: You paid your performance marketing agency a $4,000 monthly retainer.

Creative Production: You hired a freelancer to create a set of video ads, which cost $2,500.

Software Costs: Your landing page software and analytics tools run about $500 per month.

Team Salaries: Your marketing manager, who earns $72,000 annually ($6,000/month), spent roughly one-third of their time on this campaign. That’s $2,000 in salary costs right there.

Now, let's tally up the real investment.

Ad Spend: $20,000

Agency Fee: $4,000

Creative Cost: $2,500

Software: $500

Prorated Salary: $2,000

Total Marketing Cost: $29,000

With this much more accurate cost, let's run that ROI calculation again.

True ROI:

Suddenly, your ROI has dropped from a stellar 400% to 245%. While it's still a healthy return, this more realistic figure provides a much clearer basis for making smart decisions. It hammers home the importance of tracking every single dollar to understand what truly drives profitable growth.

Seeing the Bigger Picture with Customer Lifetime Value

Calculating ROI based only on the first sale is like judging a movie by its opening scene. You get a snapshot, but you completely miss the plot. Real marketing success isn’t just about landing one-off sales; it’s about winning over customers who come back, buy again, and become more valuable to your business over time.

This is exactly where Customer Lifetime Value (LTV) comes in, and it will fundamentally change how you see marketing profitability.

If you only look at the initial return, you’ll naturally favor campaigns that attract one-and-done discount hunters instead of ones that build real loyalty. A campaign might look weak upfront with a low ROI, but it could be quietly delivering customers who generate revenue for years. Without LTV in your toolbox, you might kill a campaign that’s actually a long-term profit engine.

Why LTV is a Game-Changer for ROI

When you start weaving LTV into your analysis, the entire conversation shifts from short-term wins to building sustainable, long-term growth. It forces you to think about the entire customer journey—from that very first click all the way to their tenth purchase. This long-range perspective is absolutely essential for SaaS, subscription services, and any e-commerce brand that relies on repeat business to survive.

Let's walk through a real-world scenario.

Campaign A (High Initial ROI): You put $5,000 into a campaign and get 100 new customers. They each make a $100 purchase, bringing in $10,000 in revenue. That’s a clean 100% ROI. Sounds great, right? But these customers were lured in by a massive discount and never come back.

Campaign B (Lower Initial ROI): You spend the same $5,000 but only acquire 50 new customers, who also make a $100 purchase. Your initial revenue is just $5,000, which means you’re looking at a 0% ROI. On paper, this campaign looks like a total flop.

But let's fast-forward a year. Those 50 customers from Campaign B, who were drawn in by your brand's quality and message, go on to spend an average of $400 more each. The total lifetime value from this small group swells to $25,000 (50 customers $500 LTV). Your long-term ROI is now a massive 400%.

Campaign B was the hands-down winner, but you’d never have known it by just glancing at the first sale.

Your North Star Metric: The LTV to CAC Ratio

The relationship between how much a customer is worth to you (LTV) and how much it costs to get them (Customer Acquisition Cost, or CAC) is one of the most vital health metrics for your entire business. The LTV:CAC ratio is the ultimate report card for your marketing efforts.

It tells you if your growth is actually profitable and sustainable.

As the visual shows, a healthy business invests in acquiring customers who will generate far more value than what was spent to bring them in.

This completely reframes how you look at the numbers, especially if you're in B2B or run a subscription model. Most successful companies aim for an LTV:CAC ratio of 3:1 to 4:1 as their benchmark for healthy growth. For every dollar you spend acquiring a customer, you should expect to get three or four dollars back over their lifetime.

For instance, if your average LTV is $12,000 and your CAC is $3,000, you’ve hit a 4:1 ratio. That's a sign of a very strong and profitable marketing machine. You can get more details on how benchmarks like these impact your ROI from this in-depth guide on calculating marketing campaign ROI.

If your LTV:CAC ratio is hovering around 1:1, alarm bells should be screaming. You’re spending a dollar to make a dollar, which is just a fast way to burn through cash with zero profit. It's a critical signal to hit the brakes on acquisition and figure out your unit economics.

To get LTV right, you can't just project future revenue. You have to account for variables like customer retention rates, average contract lengths, and potential upsell opportunities. A quick, naive calculation can be wildly off, causing you to overstate your true ROI and make some seriously bad investment decisions.

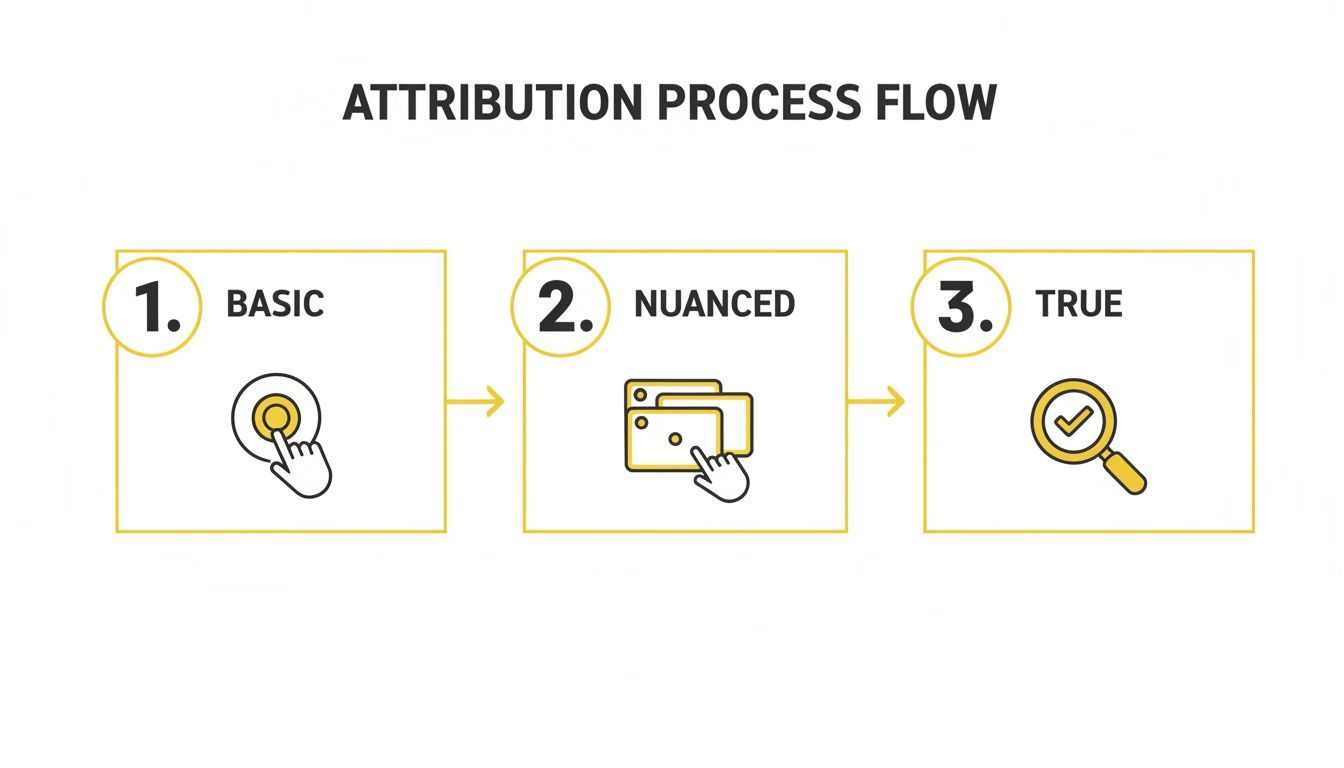

Solving the Attribution Puzzle for Accurate Revenue

Can you say, with total confidence, which touchpoints drove that last sale? If the answer is anything less than a resounding "yes," you're probably guessing where to put your next marketing dollar. That's a fast track to a wasted budget.

This is the classic attribution puzzle. For years, marketers clung to simplistic models like "last-click," which hands 100% of the credit to whatever a customer clicked right before buying. It’s neat and tidy, sure, but it's also deeply flawed. It completely ignores every other ad, email, and social post that guided the customer on their journey.

You can get a bit more sophisticated with multi-touch models like linear or time-decay, but even they are just educated guesses. They distribute credit based on assumptions, not hard proof. To really nail your marketing's impact, you have to dig deeper.

The Power of Incrementality Testing

The real question isn't "Which ad got the click?" It’s this: "Did my marketing cause this sale to happen, or would it have happened anyway?"

That’s the core concept of incrementality. It’s all about measuring the true "lift" your campaigns provide over and above what would have happened organically. Instead of just seeing a correlation between ad views and sales, incrementality proves your ads were the reason for the spike.

Key Takeaway: Attribution models show you the path a customer took. Incrementality testing tells you if your marketing was the reason they took that path in the first place. This distinction is everything when you need a defensible ROI calculation.

How do you measure this lift? Through controlled experiments. Think A/B tests on a grander scale, using geo-split tests or holdout groups. You compare results from a group that saw your marketing against a control group that didn't. The difference is your incremental lift—the real, undeniable value you created.

A Practical Example of an Incrementality Test

Setting up an incrementality test sounds more complex than it is. Let's walk through a common scenario. Imagine an e-commerce brand wanting to find out if its Facebook retargeting ads are actually working.

Here’s a simple holdout test they could run:

Define the Audience: They start with their standard retargeting audience—say, 100,000 people who visited their site in the last 30 days.

Create Two Groups: They randomly split this audience. The "test" group gets 90% of the audience (90,000 people) and will see the ads. The "holdout" or "control" group gets the remaining 10% (10,000 people) and will be completely excluded.

Run the Campaign: The campaign runs as usual, but it only targets the test group. They let it run for a set period, like 30 days, to get solid data.

Analyze the Results: After the test, they simply compare the conversion rates of the two groups.

Let's say the numbers came back like this:

Group | Audience Size | Conversions | Conversion Rate |

|---|---|---|---|

Test Group (Saw Ads) | 90,000 | 4,500 | 5.0% |

Holdout Group (No Ads) | 10,000 | 300 | 3.0% |

The holdout group’s 3.0% conversion rate is your organic baseline. These are the people who were coming back to buy anyway. The real magic is in the difference: the 2.0% gap between the groups is the incremental lift caused directly by the retargeting ads.

This proves the ads generated an extra 1,800 conversions (2% of the 90,000 people in the test group). That's your true impact.

Calculating Incremental ROI

When you start calculating ROI this way, the numbers can look very different from your standard attribution reports. For example, say you ran an email personalization test that cost $8,000. The group that got the personalized emails generated $50,000 in revenue, while the control group generated $30,000.

Your incremental revenue is $20,000 ($50k - $30k). That gives you an incremental ROI of 250%. You're basing the calculation on the actual lift, not just raw revenue. You can explore more on measuring return on investment to see more breakdowns like this.

This is the kind of rigorous approach that separates the pros from the amateurs. It stops you from confusing seasonal trends or baseline growth with marketing impact. By running controlled experiments, you isolate your marketing’s real contribution, calculate an ROI you can actually stand behind, and make budget decisions with confidence.

Alright, let's get into the weeds. Theory is one thing, but making these ROI calculations work with real, messy campaign data is where the magic happens. We're going to walk through two detailed scenarios—one for an e-commerce brand and another for a B2B company—to show you exactly how this plays out in the real world.

Think of this as your practical framework. Once you see it in action, you can adapt it to your own campaigns and start proving the true value of your marketing spend.

The journey from a simple, last-click view to a genuinely nuanced analysis is a big one. It's about peeling back the layers to find what's really driving growth.

As this shows, the deeper you go, the closer you get to defending the real-world impact of your marketing efforts.

E-commerce Example: A Google Shopping Campaign

Imagine you're running an online apparel store. You just launched a Google Shopping campaign for a new line of jackets, and the numbers coming out of the ad platform look fantastic.

But are they too good to be true? Let's dig in.

For one month, here are the direct results:

Total Revenue Generated: $75,000

Google Ads Spend: $15,000

A quick calculation gives you a 500% ROAS. High-fives all around, right? Not so fast. That number is dangerously misleading because it ignores the cost of doing business.

Now, let's get real and factor in all the other costs tied to this revenue.

Cost of Goods Sold (COGS): Your jackets have a 40% profit margin, which means your COGS is a hefty $45,000.

Agency Fee: You're paying a performance agency $3,000 a month to manage the campaign.

Platform Fees: Payment processors and platform fees skim 3% off the top, which comes out to $2,250.

With the full picture, we can calculate a much more honest, profit-based ROI.

Total Investment: $15,000 (Ad Spend) + $3,000 (Agency) + $2,250 (Fees) = $20,250Gross Profit: $75,000 (Revenue) - $45,000 (COGS) = $30,000True ROI: ($30,000 - $20,250) / $20,250 = 48%

Suddenly, that 500% ROAS has morphed into a 48% ROI. It’s a world of difference. The campaign is still profitable, which is great, but this realistic figure gives you the clear-eyed view you need to make smart decisions about scaling your budget.

B2B Lead Generation Example: A LinkedIn Ad Campaign

Now let's pivot to a B2B software company running LinkedIn Ads to get demo requests. This is where things get trickier. B2B sales cycles are long, and not all leads are created equal.

Here’s the top-of-funnel data from a one-quarter campaign:

LinkedIn Ad Spend: $20,000

Total Leads Generated: 200

Cost Per Lead (CPL): $100

A $100 CPL might be great or terrible—on its own, the metric is meaningless. To find the real ROI, we have to follow the money and track these leads all the way through the sales funnel.

Here’s what that data reveals:

Lead-to-SQL Rate: Of the 200 leads, the sales team qualified 50 as legitimate sales opportunities. That’s a 25% conversion rate.

SQL-to-Close Rate: Of those 50 qualified leads, 10 eventually became paying customers, giving us a 20% close rate.

Customer Lifetime Value (LTV): For this company, the average LTV of a new customer is $15,000.

Now we have what we need to calculate a truly meaningful ROI.

Total Investment: $20,000 (Ad Spend)

Total LTV Generated: 10 new customers $15,000 LTV = $150,000

Long-Term ROI: ($150,000 - $20,000) / $20,000 = 650%

A massive 650% ROI. This proves the long-term profitability of the campaign and completely justifies that initial $100 CPL. For any B2B company, this kind of full-funnel analysis isn't just nice to have; it's essential.

ROI Calculation Walkthrough: E-commerce vs. Lead Gen

Seeing these two business models side-by-side really highlights the different variables and timelines you need to consider. What matters for a quick e-commerce sale is very different from what matters for a long-cycle B2B deal.

Here’s a breakdown of how the key steps compare:

Calculation Step | E-commerce Example (Google Shopping) | B2B Lead Gen Example (LinkedIn Ads) |

|---|---|---|

Primary Goal | Direct online sales | Demo requests and qualified leads |

Initial Ad Spend | $15,000 | $20,000 |

Key Revenue Metric | $75,000 in immediate revenue | $150,000 in Customer Lifetime Value (LTV) |

Additional Costs | COGS, agency fees, platform fees | Primarily salaries of sales/marketing teams (not included in this simplified ROI) |

Timeframe | Short-term (30 days) | Long-term (90 days + sales cycle) |

Key Funnel Metric | Conversion Rate | Lead-to-SQL & SQL-to-Close Rates |

Final Calculated ROI | 48% (Profit-based) | 650% (LTV-based) |

This comparison makes it clear: your business model dictates your ROI formula. An e-commerce brand lives and dies by profit margin, while a B2B company needs to focus on the long-term value generated from its lead pipeline.

Of course, once you’ve nailed down your ROI, the work isn’t over. The next step is using these powerful insights for continuous improvement, like optimizing marketing campaigns for better ROI.

These examples show that the flashy numbers in your ad platform dashboard are just the opening chapter. The real story—and the real profit—is found when you connect every dollar you spend to the bottom line.

Common Questions About Marketing ROI

Once you’ve got the formulas down, the real questions start to pop up. The numbers are one thing, but understanding the context around them is where you start making smarter decisions. Let’s get into a few of the most common questions I hear from marketers all the time.

What's a Good Marketing ROI?

This is usually the first thing everyone asks, and the honest answer is always the same: it depends. It comes down to your industry, your specific business model, and most importantly, your profit margins.

A 5:1 ratio (which is a 400% ROI) gets thrown around a lot as a solid benchmark. For every $1 you spend, you get $5 back in revenue. But that’s just a general guideline. A high-volume e-commerce store with thin margins might be thrilled with a 3:1 ratio. On the other hand, a B2B SaaS company with high lifetime value might need to hit a 10:1 ratio to actually call it a win.

A "good" ROI for a brand awareness campaign is going to look completely different than one for a direct-response Google Ads campaign built for immediate sales. Your goals are what define success.

How Often Should You Measure ROI?

The right cadence for checking your numbers also ties back to your goals and sales cycle. You definitely don’t need to be hitting refresh on an ROI dashboard every single day for every campaign.

Short-Term Campaigns: If you’re running paid ads on platforms like Google or Meta, checking in weekly or even daily is smart. It lets you make quick, tactical changes to your bids, creative, and targeting before you burn through your budget.

Long-Term Strategy: For bigger plays like content marketing or SEO, looking at ROI quarterly or semi-annually makes way more sense. These channels are a slow burn; they take time to build momentum, and judging them too early will just give you a skewed picture.

The big takeaway here is to match your measurement frequency to the timeline you expect to see an impact. Obsessing over the daily ROI of a six-month SEO project is a recipe for frustration and terrible decisions.

Handling Imperfect or Incomplete Data

Let's be real: perfect, clean data is a myth. You'll always have gaps. Maybe you got a flood of offline sign-ups from a trade show, or a new customer mentions hearing about you on a podcast that’s impossible to track with a pixel. So what do you do when you can't track everything?

You make educated estimates and use proxies to fill in the blanks.

For those offline conversions, try using unique discount codes or dedicated landing pages for event attendees to connect the dots. Another great tactic is simply adding a "How did you hear about us?" field to your checkout or sign-up forms. It’s self-reported data, sure, but it can shine a light on the channels your digital analytics are completely missing.

Don't let the hunt for perfect data paralyze you. Start with what you can measure reliably, clearly document the assumptions you're making for the rest, and just keep refining your process. A directionally correct ROI based on solid estimates is a thousand times more valuable than no calculation at all.

At Wojo Media, we don't guess—we build predictable, profitable growth by tracking what actually matters. If you're ready to scale your business with a data-driven ads strategy, book a free demo call with us today.

.png)

Comments