How to Get Mortgage Leads A Modern Playbook for Lenders

- Jason Wojo

- Dec 23, 2025

- 16 min read

Before you spend a single dollar on an ad, you need to build the strategic foundation for your lead generation machine. This is about more than just a vague idea of who you want to reach. It’s about precisely defining your ideal borrower, setting a budget that actually makes sense for your business, and getting the right tech in place to automate and scale everything.

And underneath it all, compliance has to be the bedrock of your entire system.

Building Your Foundation for a Steady Flow of Leads

Jumping straight into paid ads without a solid plan is the fastest way to burn through your marketing budget. Forget about ad copy and campaign targeting for a minute. First, you have to build the essential infrastructure that will support your lead gen engine for the long haul.

This foundational work isn't the exciting part, I get it. But it’s what separates the loan officers who are constantly scrambling for clients from those who have a predictable, steady pipeline. It all comes down to clarity and preparation—knowing exactly who you're talking to, what you're willing to pay to get them, and having the systems ready to handle the leads when they start rolling in.

Define Your Ideal Borrower Profile

You have to move way beyond generic labels like "first-time homebuyers." A truly powerful borrower profile, or avatar, digs into the psychographics—the fears, motivations, and daily habits of your ideal client.

Think about it. Where are they actually spending their time online? Are they just scrolling through Zillow listings for fun on a Tuesday night, or are they anxiously Googling "how much house can I afford" on their lunch break?

Get specific when you're building this profile:

Financial Pain Points: What keeps them up at night? Is it the down payment, the confusing interest rates, or just the sheer mountain of paperwork?

Information Sources: Who do they trust for advice? Is it their real estate agent, a financial guru on YouTube, or a random commenter on a Reddit forum?

Life Stage Triggers: What major event is pushing them to look for a house? A marriage, a new baby, a job relocation—each one comes with a totally different sense of urgency and emotional state.

When you understand these nuances, you can craft messaging that cuts through the noise. Your ads will stop feeling like a sales pitch and start feeling like the exact solution they’ve been searching for.

Set a Practical Budget and Choose Your Tech Stack

Your marketing budget can't just be a number you pull out of thin air. It needs to be tied directly to your business goals. Start by calculating your average commission per closed loan, then work backward to determine your target Cost Per Acquisition (CPA).

If you make an average of $4,000 per loan, you can decide exactly how much of that you're willing to invest to land that client. This data-driven approach takes the emotion out of your spending and turns it into a predictable business calculation.

At the same time, you absolutely need the right tools to manage and nurture your leads. A solid tech stack isn't a luxury anymore; it's essential for scaling.

CRM (Customer Relationship Management): This is your command center. It tracks every lead, conversation, and follow-up.

Landing Page Builder: You need dedicated, high-converting pages built specifically for your ad campaigns. Don't just send traffic to your homepage.

Email/SMS Automation Software: This is critical. Immediate follow-up is everything when it comes to converting online leads, and automation makes it happen.

To get this foundation built right, you should look into some of the best lead generation tools out there that can help streamline these processes.

Understand Compliance from Day One

Compliance is not an afterthought. It has to be a core part of your strategy from the very beginning. Regulations like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA) dictate exactly how you can advertise mortgage products. Ignoring them can lead to massive fines and a ruined reputation.

A huge recent change is the Homebuyers Privacy Protection Act, which severely restricts the use of "trigger leads." This makes your ability to generate your own, exclusive leads more critical than ever before.

Making sure your ads, landing pages, and all follow-up communications have the necessary disclosures and avoid any misleading claims will protect your business. More importantly, it builds trust with potential borrowers from the very first click.

Launching Paid Ad Campaigns That Actually Convert

Alright, with the foundation set, it’s time to flip the switch and start bringing qualified borrowers to your door. This is where strategy turns into action. Paid advertising isn't just about boosting a post and hoping for the best; it’s about surgically targeting the right people, on the right platform, with a message that hits home for their specific financial situation.

The goal isn't just clicks. We're chasing high-intent individuals who are genuinely looking for a mortgage. This requires a completely different playbook for each platform. An ad that crushes it on Google will almost certainly die a slow death on TikTok. Let’s break down the tactics for the platforms that really move the needle.

Mastering Facebook and Instagram Ads

Facebook and Instagram are still absolute powerhouses for finding potential borrowers, but you have to play by their rules. Any ad related to housing gets dumped into Meta's Special Ad Category. This is non-negotiable. It means you can't target by age, gender, zip code, or a lot of the detailed interests that might point to discriminatory practices.

That might sound like a major roadblock, but I’ve found it actually forces you to be a much sharper marketer. You can't lean on lazy demographic targeting. Instead, you have to nail your ad copy and visuals to connect with your ideal client's pain points and aspirations.

You still have some powerful tools to work with:

Broad Location: You can target by state, city, or a minimum 15-mile radius around a specific point.

Special Ad Audiences: Think of these as compliant lookalike audiences. You can build them from your customer lists or website visitors, but Meta strips out certain demographic signals to keep things fair.

Detailed Targeting: While it's limited, you can still go after broader interests. Think about users interested in Zillow, Trulia, or topics like first-time homebuyer grants.

The real key here is to feed the algorithm good data. Get your pixel installed correctly, and as it learns who is converting on your site, it will get smarter about finding more people just like them.

Capturing High-Intent Borrowers with Google Ads

If social media is about creating awareness, Google is where you go to capture it. When someone types "mortgage lenders near me" or "best FHA loan rates" into that search bar, they aren't just window shopping. They have a real, immediate need. This makes Google Ads an absolutely essential part of your lead gen machine.

The platform lets you target people with incredible precision based on the exact phrases they're searching for. For a deeper dive into the mechanics, this complete guide to Google Ads lead generation is a great resource.

My biggest piece of advice here? Focus your budget on "in-market" audiences for mortgages. Google has already done the work to identify these users as people actively researching and comparing mortgage products. Adding this one targeting layer can dramatically boost your ROI by weeding out tire-kickers.

For instance, a campaign for first-time buyers should bid on keywords like "down payment assistance programs" and "first time home buyer loan requirements." A refinance campaign? That should be all over terms like "cash out refinance calculator" or "lower my mortgage payment." It’s all about meeting them exactly where they are.

Crafting Ad Copy and Visuals That Stop the Scroll

Your ad creative is your digital handshake. Generic stock photos and boring headlines are a death sentence—people will scroll right past without a second thought. You need to create ads that pinpoint a specific problem and present a clear solution, all tailored to the platform you're on.

Here’s how that looks in the real world:

Scenario 1: First-Time Homebuyer on Instagram

Visual: A short, snappy Reel showing a young couple getting the keys and excitedly unlocking the door to their first place. Use some upbeat, trending audio.

Headline: Stop Renting. Start Owning.

Body Copy: Feeling lost in the homebuying maze? Our free guide cuts through the confusion, from pre-approval to closing day. Grab your copy!

CTA: Download Guide

Scenario 2: Refinance Prospect on Google

Visual: A clean, professional graphic that shows a declining interest rate chart. Simple and to the point.

Headline: Lower Your Monthly Payment | Tampa Refinance Experts

Body Copy: Rates are moving. Find out if you can save hundreds every month with a quick refi. Get a no-obligation quote in 5 minutes.

CTA: Get A Free Quote

This level of specificity is what makes your ads feel helpful, not salesy. It shows you get it. You understand their unique situation, and that's the first step to building trust and getting a lead who actually wants to pick up the phone.

Designing Landing Pages That Turn Clicks Into Clients

You did it. Your perfectly crafted ad earned the click. But getting the click is just the start of the journey. The real test begins on your landing page—it's the digital handshake that decides if a prospect trusts you enough to give you their info. This page is the critical bridge between their curiosity and them becoming a real, tangible lead in your pipeline.

One of the costliest mistakes you can make is sending paid traffic straight to your generic homepage. Don't do it. A dedicated landing page has one job and one job only: to convert that visitor. It’s stripped of all the usual distractions of a main website, guiding them toward a single, focused action: filling out your form.

The difference in performance is absolutely staggering. I've seen well-built mortgage websites and landing pages convert 5-12% of their visitors. Compare that to the less than 1% you often see on poorly designed sites, and you start to realize just how much business is left on the table without a focused approach. If you want to dive deeper into the numbers, The Broker Bot's mortgage lead guide breaks down the financial impact.

Crafting a Compelling Value Proposition

The second a visitor lands on your page, they need to know—instantly—that they're in the right place. Your headline is the first thing they see, and it has to immediately answer their unspoken question: "What's in it for me?"

A strong value proposition isn't about you; it's about solving their problem.

Weak Headline: "Your Trusted Mortgage Partner"

Strong Headline: "Get Your Pre-Approval Letter in 24 Hours"

See the difference? The second one is specific. It’s driven by a clear benefit and sets a real expectation. Promising a tangible outcome like speed is far more powerful than a vague statement about being "trusted."

Building Trust Through Social Proof and Authority

Nobody is going to hand over sensitive financial information without feeling confident that you're legit. This is where you build that confidence, sprinkling trust signals throughout the page to dismantle their natural skepticism.

For a mortgage landing page, these elements are non-negotiable:

Client Testimonials: Real quotes, preferably with photos, from happy clients. If you can get video testimonials, they're pure gold.

Licensing Information: Make your NMLS number and any state licensing details easy to find. This isn't just for compliance; it screams "I'm a real professional."

Trust Badges: Logos from the Better Business Bureau, industry awards, or other recognized organizations are quick visual cues that build instant credibility.

By layering in social proof and your credentials, you’re systematically breaking down the barriers of doubt every online visitor brings with them.

Here’s a simple but killer tactic I’ve used: place a glowing client testimonial right next to your lead form. Seeing that positive review at the exact moment of hesitation can be the final nudge someone needs to hit "submit."

Designing a Lead Form That Qualifies Without Overwhelming

The lead form itself is a delicate balancing act. You need enough information to qualify someone, but every single field you add is another reason for them to bail. The trick is to ask for just enough to get a meaningful conversation started.

Think about it in stages. I always recommend starting with a "soft" conversion—a short form that only asks for a name, email, and phone number. It’s a low-friction way to capture their core contact details.

Then, once they submit that first form, you redirect them to a "thank you" page that hosts a longer, more detailed questionnaire. This is where you can dig into things like estimated credit score, income, and property type. The beauty of this approach? Even if they don't finish the second part, you've already captured their contact info and can still follow up.

Building Referral Networks with Real Estate Agents and Partners

Paid ads are a fantastic way to fill your pipeline, but let’s be honest—some of the absolute best, most qualified leads you'll ever get won't come from an ad. They'll come from people.

A solid referral network is its own lead-gen engine, one that runs on trust and relationships. These aren't just cold clicks; they're warm introductions from professionals your clients already know and respect. When a real estate agent or financial planner they trust sends them your way, that credibility transfers to you. It’s a massive head start that cold traffic just can’t compete with.

Identifying and Connecting with Key Referral Partners

First things first, you need a game plan for who can consistently send business your way. Real estate agents are the obvious starting point, but don't stop there. You need to think bigger.

Your ideal partners are the professionals who are already in the room when major life and financial decisions are being made. They're often the first to know someone is even thinking about a new home or a refi.

Financial Planners: They’re mapping out long-term goals with clients, and homeownership is almost always part of that picture.

Divorce Attorneys: A change in marital status very often means one or both parties need to secure a new mortgage.

CPAs and Accountants: These folks have an intimate understanding of their clients' finances and are usually consulted before any major purchase.

Insurance Agents: Every mortgage requires homeowners' insurance, making this a perfectly natural partnership.

When you make contact, ditch the generic "let's trade leads" pitch. That’s a fast track to being ignored. You have to lead with value. Offer to co-host a first-time homebuyer workshop, provide some killer content for their client newsletter, or just be the go-to person they can call with a tricky mortgage question.

A simple, effective script could sound something like this: "Hey [Partner's Name], I've been following your work and I'm really impressed with [mention something specific]. I specialize in [your niche] and I’m always looking for a top-tier [their profession] to send my own clients to. I’d love to grab coffee and see how we can help each other’s clients win."

This immediately frames you as a collaborator, not just someone with their hand out.

Co-Marketing and Providing Reciprocal Value

Great partnerships are a two-way street. The goal isn't just to get leads; it's to become so valuable to your partners that sending you business is a complete no-brainer. This is where you get creative with co-marketing.

Propose concrete ways you can grow your businesses together.

Co-Hosted Events: A "Homebuying 101" webinar hosted by a loan officer and a real estate agent is a classic for a reason—it works.

Shared Content: Create a co-branded PDF, like a "Checklist for First-Time Homebuyers," that you can both distribute to your audiences.

Joint Social Media Campaigns: Jump on an Instagram Live together to answer market questions or host a Q&A session in a local Facebook group.

Ultimately, your job is to make your partners look good. When you deliver lightning-fast pre-approvals, communicate like a pro throughout the process, and nail a smooth closing, you aren't just serving the client. You're cementing your partner's reputation, and that’s the kind of value that earns you referrals for life.

Tapping into Local Micro-Influencer Networks

Beyond the traditional professionals, a powerful new source of referrals has popped up: local micro-influencers. These are people on social media with smaller, but incredibly engaged, local followings. They specialize in everything from your city's real estate scene to personal finance for millennials.

An endorsement from a trusted local voice can feel far more authentic than a polished ad. Partnering with these creators is quickly becoming a high-ROI play for mortgage leads. In fact, 68% of brands report getting better returns from creators with fewer than 50,000 followers compared to mega-influencers. Real-world results show these focused partnerships can easily outperform traditional ad spend. You can find more insights on high-quality mortgage leads to see how this works in practice.

Start by looking for influencers in your area whose content aligns with your brand. Find the people creating genuinely helpful content about your city or about finance for your target demographic. Reach out with a clear proposal for a sponsored post, a series of Instagram Stories explaining the pre-approval process, or a YouTube collaboration. It's a direct line into a pre-built community that already trusts the messenger.

Using Automation to Nurture Leads Without Losing the Personal Touch

In the mortgage game, speed is everything. It's not just an advantage; it's the whole ballgame. The second a potential borrower hits "submit" on a form, a clock starts ticking. If you don't engage them, and fast, you can bet they’re already clicking on the next lender in their search results.

This is where automation becomes your most valuable player. It's not about blasting prospects with generic, robotic messages. It's about building a smart, multi-channel system that nurtures interest, delivers real value, and keeps your name at the top of their list. A good system works for you 24/7, making sure no opportunity ever goes cold.

Building Your Automated Nurturing Workflow

Your first move is to map out a logical communication sequence inside your CRM. This workflow should fire off the instant a new lead lands in your system. The goal is a blend of digital touches that feel personal and genuinely helpful.

A powerful opening sequence can make all the difference. Here’s a battle-tested approach:

The First 5 Minutes: An automated SMS message goes out immediately. This is non-negotiable. Text messages have an insane open rate—as high as 98%. Keep it simple: "Hi [First Name], this is [Your Name]. Just got your inquiry about a home loan. I'm reviewing it now and will call you in about 10-15 minutes from this number."

15 Minutes Later: Your CRM should automatically create a task for you to make a manual call. That initial text has already warmed them up and set the expectation.

1 Hour Later: An automated "welcome" email lands in their inbox. This email should confirm you received their info, briefly introduce yourself and what makes you different, and—this is key—provide a piece of valuable content. Think a guide on the "Top 5 Mistakes First-Time Buyers Make" or a simple checklist.

This immediate, multi-pronged attack ensures you make contact quickly and start positioning yourself as the go-to expert from the get-go.

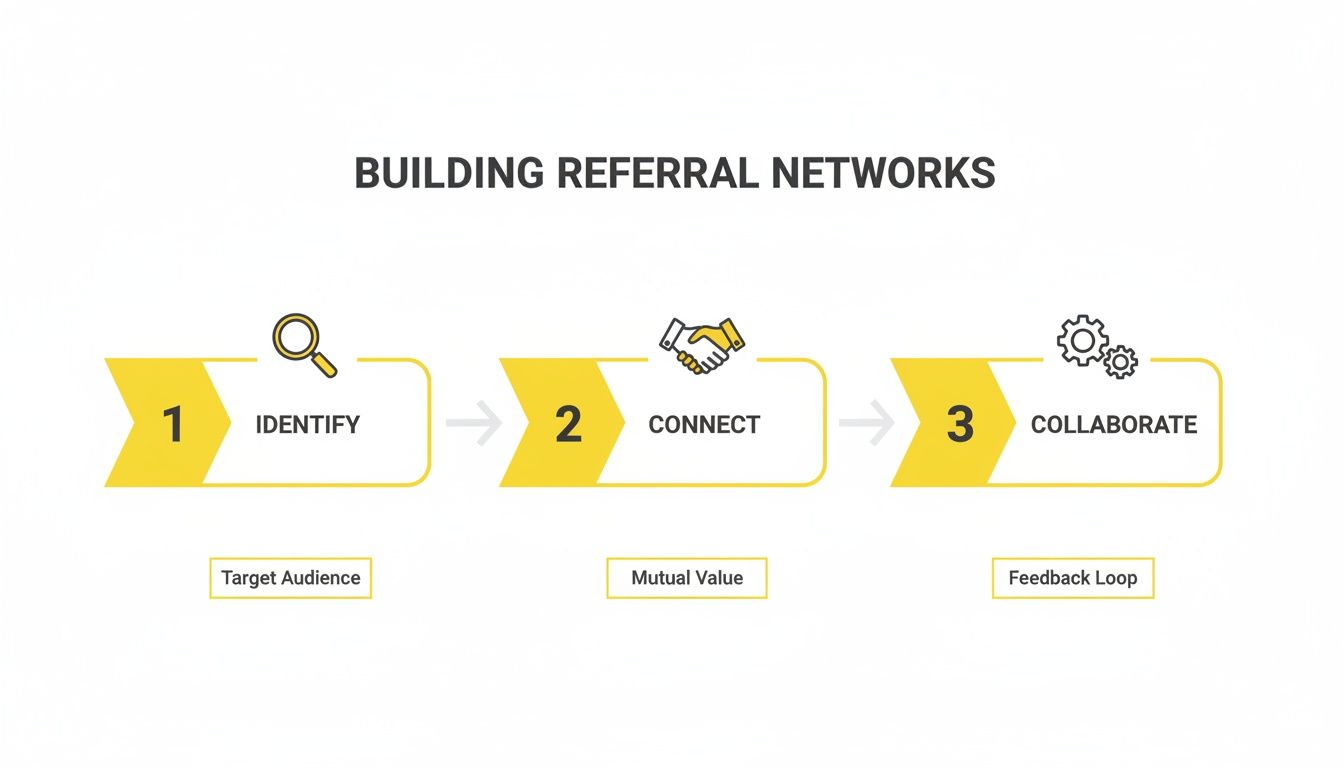

The process below, while designed for building referral networks, applies perfectly here. It’s all about a structured flow: identify the need, connect personally, and collaborate towards a goal.

Whether it's a new lead or a potential partner, success relies on a defined series of actions that build on each other to forge a strong relationship.

Writing Content That Nurtures and Converts

Your automated messages have to do more than just say "hello." Every text and email needs a purpose. You should be answering common questions, overcoming objections, and gently guiding the prospect to the next logical step.

Put yourself in the borrower's shoes. What are their biggest fears? What questions are keeping them up at night? Create content that hits those points head-on.

A great nurturing campaign feels less like a sales pitch and more like a free consultation spread out over time. You're not just a lender; you're the expert guide they need to navigate a complex process.

Build a library of content you can drip out over several weeks. This could be short videos explaining the difference between FHA and conventional loans, blog posts that demystify the closing process, or infographics that show the path from pre-approval to closing day.

Using Lead Scoring to Prioritize Your Hottest Prospects

Let's be real: not all leads are created equal. Some are ready to apply today, while others are just kicking tires and might be six months out. Lead scoring is how you separate the hot from the cold so you know where to focus your personal attention.

It's a simple points system based on their actions and data:

+10 points for visiting your "Apply Now" page.

+5 points for opening three or more of your emails.

+20 points for requesting a personalized rate quote.

-5 points if their email address bounces.

You set a threshold—say, 25 points. Once a lead hits that number, your CRM can automatically flag them as a high-priority contact and create a task for you to call them personally. This data-driven strategy ensures you spend your time where it has the biggest impact, turning your automation into a high-powered qualification machine.

Even with the best playbook in hand, diving into lead generation is going to bring up questions. It's just part of the process. As you start putting money into ads and seeing what happens, you'll run into little details and quirks that can make or break your entire budget.

Let’s get some of the most common questions I hear from lenders out of the way right now. Knowing this stuff upfront will give you the confidence to make smarter bets with your marketing dollars.

What Is a Realistic Starting Budget?

This is always the first question, and the honest-to-God answer is: it depends. But you absolutely need enough cash to buy meaningful data. A few hundred bucks just isn't going to cut it. You'll burn through that before the ad platform's algorithm even begins to figure out who your ideal customer is.

I've found the sweet spot for a starting point is somewhere between $1,500 to $3,000 per month. This gives you enough runway to actually learn something. With that kind of budget, you can:

Test out different ad images, videos, and headlines to see what people actually click on.

Let your campaigns run long enough to get real conversion data, not just a few random clicks.

Figure out which channel, whether it's Facebook or Google, is giving you the best bang for your buck.

Think of that initial budget as R&D. You're not just buying leads; you're buying intelligence. The goal is to figure out the formula so you can pour gas on the fire later.

Should I Buy Exclusive or Shared Leads?

Ah, the classic debate. Shared leads, the kind you get from big aggregators like LendingTree, are tempting because they're cheap. But that low price comes with a massive downside: you're immediately pitted against a handful of other hungry lenders who got the exact same lead at the exact same time. Your only advantage is being the fastest person on the phone. It's a race to the bottom.

Exclusive leads, the ones you generate yourself through your own marketing, belong to you and you alone. They cost more to get, sure, but the person on the other end is expecting your call.

My advice? It's almost always better to build your own engine for exclusive leads. Buying shared leads might give you a quick shot of volume, but the long-term value of nurturing a relationship with someone who came looking for you is on another level. The quality isn't even in the same ballpark.

How Do I Accurately Measure ROI?

This is where so many lenders get it wrong. They get obsessed with a simple metric like Cost Per Lead (CPL). A low CPL looks nice on a spreadsheet, but it doesn't mean you're making money. The only number that truly matters is your Return on Ad Spend (ROAS).

To figure out your ROAS, you have to look at the entire journey from the first ad click all the way to a closed loan.

Ad Spend: How much did you spend on that specific Facebook or Google campaign?

Leads Generated: How many actual, qualified leads did it produce?

Closed Loans: This is the critical step. You have to connect those leads to closed loans in your CRM.

Total Revenue: What was the total commission from the loans that came from that ad campaign?

Calculate ROAS: Now, just divide your total revenue by your total ad spend.

For instance, if you spent $3,000 on a Google Ads campaign and it led to two closed loans that brought in $8,000 in commission, your ROAS is 2.67x. That's the number that tells you if your marketing is actually working.

At Wojo Media, we don’t guess. We build predictable, profitable growth machines for our clients through omnipresent ad campaigns that deliver a steady flow of high-quality leads. We handle it all—from crafting the offers and designing the landing pages to tracking the data that really moves the needle. Book a free demo call with us today and get a custom paid ads strategy built for your mortgage business.

.png)

Comments