Lead Generation for Real Estate Investors: Secrets to Consistent Deals

- Jason Wojo

- Dec 22, 2025

- 17 min read

Real estate investing isn't about chasing every half-baked opportunity that comes your way. That's a recipe for burnout. The real pros build predictable systems that bring motivated sellers directly to them.

When you blend the precision of digital marketing with proven offline tactics, you create a consistent, reliable flow of high-quality, exclusive leads. This is the foundation that lets you stop hunting for deals and start closing them.

Building Your Investor Brand to Attract Motivated Sellers

Before a single dollar is spent on ads or one postcard hits the mail, you have to get your foundation right. A strong brand isn't some fluffy concept with a logo and a catchy slogan. It's the crystal-clear answer to why a seller should pick up the phone and call you instead of the dozen other investors clamoring for their attention.

Get this right, and your brand becomes the engine driving every single lead generation effort. It makes your message consistent and powerful, no matter where a seller finds you.

Your first job is to figure out exactly who you’re trying to help. If you try to be everything to everyone, you’ll end up being nothing to no one. You need to zero in on a specific niche of motivated sellers—people whose problems you are uniquely built to solve.

Pinpointing Your Ideal Seller Profile

Specificity is your secret weapon. Generic marketing gets tossed in the trash, but a message that speaks directly to a seller’s specific pain point? That gets a response. Think about the situations you truly want to handle.

Inherited Properties: Maybe you’re great with heirs who live out of state and just want to be done with a property they never wanted.

Tired Landlords: You could be the go-to solution for property owners who are completely burnt out from tenants, toilets, and turnover.

Pre-Foreclosure: Perhaps you can provide a lifeline to homeowners in financial distress who need a fast, cash sale to save their credit.

Distressed Properties: You might specialize in homes with major repair needs that the owner can't afford or simply doesn't want to deal with.

By focusing on one or two of these profiles, you can tailor every single piece of your marketing—from your website copy to your Facebook ads—to hit them right where they are. This targeted approach is how you stop getting junk leads and start getting calls from people who genuinely need your help.

Crafting Your Unique Value Proposition

Once you know who you're talking to, you have to get razor-sharp on what you offer them. Your unique value proposition (UVP) is a short, punchy statement that communicates the #1 benefit you provide. It’s not just about offering cash; it’s about the solution you represent.

Your UVP should answer a seller's unspoken question: "Why should I trust you to solve my specific problem?" A powerful UVP might be "We buy inherited homes as-is in 14 days, so you can skip the repairs, listings, and stress."

See how that works? It’s specific, it’s loaded with benefits, and it sets a clear expectation. Right away, you’re not just another “we buy houses” guy; you’re a specialist.

For any investor, generating leads and actually converting them are two sides of the same coin. Building a strong brand message is the critical first step. You can dig into more advanced strategies by reading How To Generate Leads And Increase Conversions For Your Real Estate Agency to keep your deal pipeline full.

Winning the Digital Game with Targeted Online Ads

Let's be real: your digital presence isn't just an option anymore. It’s the new storefront where motivated sellers start looking for answers. To really move the needle, you have to go beyond the old-school methods and dive into the world of targeted online advertising. This is how you build a lead generation machine that runs 24/7.

Imagine putting your exact message in front of homeowners in specific zip codes who’ve owned their property for over 20 years. That's not a fantasy. Platforms like Facebook and Google make it possible, turning your marketing from a shotgun blast into a laser-guided missile.

Mastering Hyper-Targeted Facebook Ads

Facebook is an absolute goldmine for investors. Why? Because you can target people based on thousands of data points—demographics, life events, behaviors, you name it. We're talking way beyond just targeting a city; this is about crafting an audience of people who are far more likely to be motivated.

Think about what you can do here:

Geographic Targeting: Zero in on entire zip codes, draw custom circles around specific neighborhoods, or even cut out areas you don’t want to touch.

Demographic Layers: Stack criteria like age ranges (think 55+ for potential downsizers), homeownership status, and even estimated income.

Behavioral and Interest Targeting: You can’t target "motivated seller" directly, but you can get creative. Think about life events that often trigger a sale, like "newly engaged," "recently moved," or interests in "financial planning."

This is all about building a very specific profile of your ideal seller. You’re making sure every dollar you spend is reaching people who are actually likely to need you. And the data backs this up. Social media has become a true powerhouse for real estate leads, with 46% of realtors calling it their top source for high-quality leads. It's simply outperforming many of the older methods.

Capturing High-Intent Leads with Google Ads

If Facebook helps you find potential sellers, Google Ads helps you get found by them. This is a game-changing difference. When a homeowner searches for "sell my inherited house fast" or "cash offer for my home in Tampa," they aren't just window shopping. They have a real, immediate problem they need to solve.

Your mission is to be the first solution they see at that exact moment. You do this through Pay-Per-Click (PPC) advertising, where you bid on the specific phrases they're typing into the search bar.

Pro Tip: Don't waste your budget on broad terms like "sell my house." Get specific. Focus on long-tail keywords that signal serious motivation, like "stop foreclosure sell house" or "sell my house as-is for cash." The search volume is lower, but the conversion rates are through the roof.

Success on Google Ads comes down to one word: relevance. Your ad needs to mirror the searcher's query, and the landing page they click to must deliver on that promise. A campaign for "tired landlords" has to land on a page that speaks directly to the headaches of managing tenants, not a generic "we buy houses" page. When you nail this alignment, your conversion rates climb and your cost per lead drops.

To put it all in perspective, here's how these channels stack up against each other for finding motivated sellers.

Comparing Top Digital Lead Generation Channels

This table breaks down the main digital channels, giving you a quick look at where they shine, what you can expect to spend, and what metrics really matter for real estate investors.

Channel | Best For | Typical Cost | Key Metric to Track |

|---|---|---|---|

Facebook Ads | Building brand awareness and finding potential sellers before they start actively searching. Great for targeting specific demographics and life events. | $500 - $2,000+/mo | Cost Per Lead (CPL), Click-Through Rate (CTR) |

Google Ads (PPC) | Capturing high-intent sellers who are actively searching for a solution right now. Perfect for immediate lead flow. | $1,500 - $5,000+/mo | Cost Per Acquisition (CPA), Conversion Rate |

Content Marketing/SEO | Establishing long-term authority and generating "free" organic leads by answering sellers' questions. A long-term play. | $1,000 - $4,000+/mo | Organic Traffic, Keyword Rankings, Leads from Organic |

Email Marketing | Nurturing leads you've already generated. Essential for staying top-of-mind and converting prospects over time. | $50 - $300+/mo | Open Rate, Click-Through Rate, Conversion Rate |

Choosing the right channel really depends on your immediate goals and budget. Google Ads gets you in front of people with an urgent need, while Facebook and SEO are fantastic for building a consistent, long-term pipeline.

Finding Off-Market Deals with Proven Offline Methods

While your digital ad campaigns are humming along, some of the most lucrative deals you'll ever find will never hit Zillow or the MLS. These off-market properties are a goldmine for investors who are willing to roll up their sleeves and do a little old-school groundwork.

Getting good at these classic, time-tested tactics is what separates the pros from the amateurs. It’s all about creating your own opportunities instead of just waiting for them to pop up in your inbox.

Mastering the Art of Direct Mail

Let's get one thing straight: direct mail isn't dead. Bad direct mail is dead. When you do it right, a physical piece of mail cuts through all the digital noise and lands right in the hands of a potential seller. The secret isn't blasting out thousands of generic postcards; it's about surgical targeting.

You need to start with high-quality, niche lists where the seller's motivation is practically built-in.

Probate Lists: Heirs who just inherited a property are often eager to sell quickly and settle the estate. This is a huge opportunity.

Tax-Delinquent Lists: An owner falling behind on property taxes is a massive red flag for financial distress. They're often open to a fast cash offer to solve their problem.

High-Equity Absentee Owners: These are landlords who have owned a property for a long time, don't live in it, and have a ton of equity. Many are just tired of dealing with tenants and are ready to cash out.

Your mailer needs to be painfully simple and direct. Forget the long, stuffy letters. A simple postcard with a bold headline like, "I Want to Buy Your House on Main Street" almost always works better. The goal here isn't to sign a contract from a postcard—it's just to get them curious enough to pick up the phone.

Driving for Dollars: The Ultimate Sweat Equity

One of the absolute best, lowest-cost ways to find deals is still "Driving for Dollars." It's exactly what it sounds like: you physically drive through neighborhoods you want to invest in, actively hunting for houses that look neglected or distressed.

You’re looking for the visual cues that scream "this owner might have a problem." Keep your eyes peeled for the classic signs:

Grass that's a foot high and weeds taking over the flowerbeds

Boarded-up windows or doors

Mail overflowing from the mailbox

A tarp on the roof or paint peeling off in sheets

Official-looking code enforcement notices taped to the door

When you find one, write down the address. A critical skill for any investor is learning how to find distressed properties for investing. After you have the address, you can use public records or a skip-tracing service to track down the owner’s info and reach out with a personal touch.

Driving for Dollars is pure sweat equity. It takes time and gas money, but the leads you uncover are 100% exclusive to you. You aren't competing with a dozen other investors who bought the same list.

Bandit Signs and Building a Referral Network

Okay, they can be a bit controversial, but well-placed "bandit signs" can be shockingly effective for grabbing leads in a specific area. A simple sign at a busy intersection that says "We Buy Houses FAST - Cash Offer" with your phone number still pulls calls. Why? Because it catches people who have an immediate, pressing need. Just make sure you know the local city ordinances to avoid getting fined.

But the real long-term power play in offline marketing is building a rock-solid referral network. Think of it as creating your own private team of "bird dogs" who send deals straight to you. You want to connect with professionals who regularly bump into people who need to sell a property.

Professional | Why They're a Great Referral Source |

|---|---|

Probate Attorneys | They are literally managing estates with houses that need to be sold. |

Divorce Lawyers | Their clients often need to liquidate marital assets, including a house, quickly. |

Contractors & Plumbers | They're the first to know when a property has major deferred maintenance. |

Property Managers | They know exactly which landlords in their network are tired and ready to sell. |

Building these relationships doesn't happen overnight. You can't just ask for leads on day one. It's about taking them to lunch, providing them with value, and showing them you’re a reliable problem-solver they can trust with their clients. Once you become their go-to investor, you'll get a steady flow of the best off-market deals sent right to your phone.

Turning Clicks into Conversations with Compelling Offers

Getting someone to click your ad is just the first domino to fall. The real work begins when you have to turn that initial flicker of interest into an actual conversation. This is where your offer and landing page become your most valuable players.

A motivated seller isn’t just window-shopping for a cash offer; they're desperately seeking a solution to a problem. Your job is to show them you have it.

Is it the speed and certainty of a closing date they can bank on? Or maybe it’s the sheer relief of you handling all the messy repairs and closing costs? These are the real-world problems that, when solved, turn a casual browser into a hot lead.

Crafting an Irresistible Offer

A powerful offer cuts through the noise and speaks directly to a seller's pain point. Forget generic slogans like "We Buy Houses." Your offer needs to communicate a clear, tangible benefit that solves their specific problem. This is how you immediately stand out from every other investor in your market.

Let's look at a few angles that actually work:

The Speed Offer: "Get a Fair Cash Offer in 24 Hours & Close in 7 Days." This is a lifeline for sellers facing foreclosure, a sudden job relocation, or any other urgent financial crunch.

The Convenience Offer: "Sell Your House As-Is. No Repairs, No Cleaning, No Hassle." This is pure gold for tired landlords or anyone with a distressed property they can't afford to fix up.

The Certainty Offer: "Guaranteed Closing Date. No Showings, No Banks, No Waiting." This is all about reassuring sellers who are terrified of deals falling through or the endless uncertainty of the traditional market.

The key is consistency. Your ad copy, landing page headline, and call-to-action should all sing the same tune, creating a seamless and trustworthy experience from start to finish.

Anatomy of a High-Converting Landing Page

Think of your landing page as a specialist, not a general practitioner. It has one job and one job only: to convert a visitor into a lead. It’s not your main website, cluttered with a dozen links and distractions. It’s a focused, persuasive pitch designed to get a seller to hand over their contact info.

Every single element on the page needs to pull its weight, building trust and pushing the visitor toward action.

A great landing page isn’t about flashy design; it’s about clarity and empathy. It should immediately answer the seller's question: "Am I in the right place, and can these people solve my problem?"

Here are the non-negotiable pieces you absolutely must get right:

A Killer Headline: Your headline has to grab them by the collar and mirror the promise you made in your ad. If your ad said, "Sell Your Inherited House Fast," your headline should deliver on that with something like, "Finally Sell Your Inherited House and Get Your Cash in as Little as a Week."

A Clear Call-to-Action (CTA): Use strong, action-focused language. "Get My Free Cash Offer Now" or "Request a No-Obligation Offer Today" work so much better than passive phrases. Make the CTA button big, bold, and impossible to miss.

A Simple Lead Capture Form: Only ask for what you absolutely need. We're talking property address, name, phone, and email. Every extra field you add is another reason for them to bail. Keep it lean.

Social Proof and Trust Signals: This is how you crush skepticism. Real testimonials from past sellers, your Better Business Bureau rating, or "as seen on" logos from local news outlets build instant credibility and make you look like the real deal.

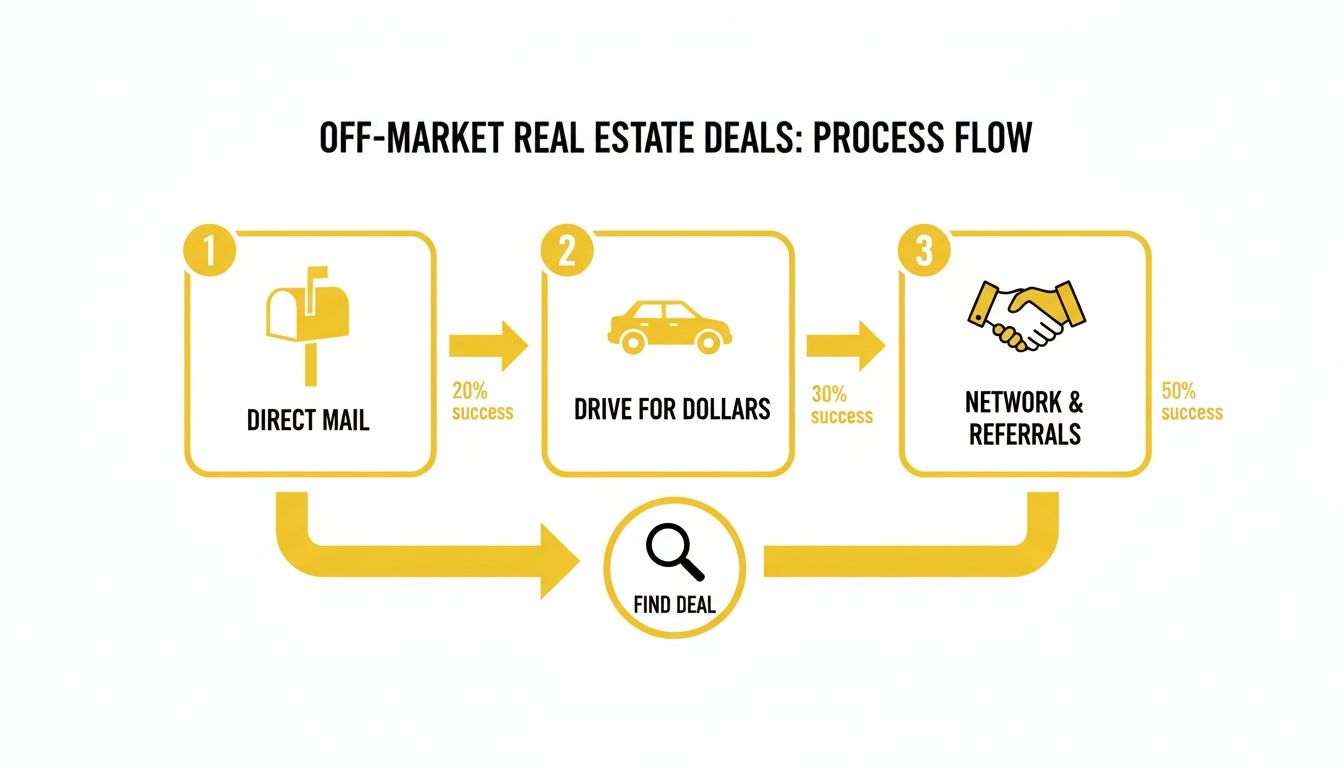

The flowchart below gives you a bird's-eye view of how different lead sources, even old-school offline ones, all funnel into the same conversion system.

Whether you’re sending direct mail or driving for dollars, every road leads back to the same goal: starting a real conversation with a motivated seller.

Tracking Your Marketing Spend for Maximum ROI

Smart investors don't guess—they measure. Firing off ad campaigns or dropping thousands on mailers without a rock-solid way to track your results is like trying to drive blindfolded. You're definitely spending money, but you have no idea if you're actually getting closer to your destination or just burning through cash.

This is where so many investors stumble. They get fired up about generating leads, throw money at a channel, and then have zero clarity on what actually moved the needle. The goal isn't just to get your phone to ring; it's to generate profitable deals. That simple shift in mindset demands a relentless focus on the numbers.

Establishing a Realistic Marketing Budget

You don't need a crystal ball to set a marketing budget, but you do need to be practical. Forget the idea that you need a massive war chest to get any traction. The truth is, many of the most successful investors I know operate on surprisingly lean budgets.

A recent survey found that 52.2% of real estate investors spend less than $1,000 per month on their marketing. That's a huge tell. Success isn’t about the size of your spend; it's about the efficiency of your strategy. The same study showed that 82.6% of investors manage their paid lead gen in-house, precisely so they can maximize every single dollar. If you want to dig into how investors are optimizing their spend, you can explore these industry lead generation statistics.

This data is proof that a focused, well-managed budget can run circles around a larger, undisciplined one every single time. Start with an amount you're comfortable testing with, and let the data tell you where to put the next dollar.

Key Metrics That Actually Matter

Forget about vanity metrics like "likes," "impressions," or "reach." As an investor, your world revolves around a handful of Key Performance Indicators (KPIs) that directly impact your bank account. Tracking these is non-negotiable if you want to build a predictable, scalable business.

Here are the only numbers you need to live and breathe for every single campaign:

Total Marketing Spend: The all-in cost for a specific channel (e.g., $500 on a direct mail campaign).

Total Leads Generated: How many unique, qualified sellers actually contacted you from that campaign?

Cost Per Lead (CPL): This is your Total Marketing Spend / Total Leads Generated. A $500 spend that brings in 10 leads gives you a $50 CPL.

Leads to Appointment Ratio: What percentage of those leads actually let you walk their property? This is a huge indicator of lead quality.

Appointment to Contract Ratio: Of all your appointments, how many turn into a signed purchase agreement? This measures how effective you are at closing.

Cost Per Acquisition (CPA): This is the holy grail metric. It's the total marketing cost to get one signed deal on the books.

CPL is important, but your CPA tells the real story. A $10 lead that goes nowhere is infinitely more expensive than a $200 lead that turns into a $30,000 profit. Always remember that.

Analyzing Your Results to Scale Smartly

Once you've run a few campaigns, the real fun begins: the analysis. Don't overcomplicate it. Just lay out your numbers in a simple spreadsheet, comparing each marketing channel side-by-side.

Marketing Channel | Total Spend | Leads Generated | CPL | Deals Closed | CPA |

|---|---|---|---|---|---|

Direct Mail | $1,200 | 12 | $100 | 1 | $1,200 |

Facebook Ads | $800 | 16 | $50 | 0 | $800+ |

Google Ads | $1,500 | 10 | $150 | 1 | $1,500 |

At first glance, the Facebook Ads campaign looks like a winner with that juicy $50 CPL. It feels good to get cheap leads, right? But look closer—it didn't produce a single deal. Meanwhile, direct mail and Google Ads, despite their higher cost per lead, both delivered a signed contract.

This is the power of making data-driven decisions. It gives you the confidence to kill what isn't working and double down on the channels that are actually putting money in your pocket. This loop—spend, track, analyze, optimize—is the engine that will drive consistent, profitable growth for your investing business.

Got Questions About Finding Deals? We've Got Answers.

Even with a solid game plan, jumping into real estate investor lead generation can feel like you're trying to drink from a firehose. There's a ton of noise out there, and getting clear, straightforward answers is the only way to build a marketing plan that actually works without burning you out.

Let's cut through the fluff. Here are the most common questions I hear from investors who are ready to get serious about finding more deals, along with some straight talk on budgeting, the fastest way to get your phone to ring, and the classic "build vs. buy" debate.

How Much Should I Actually Be Spending to Find a Deal?

There's no single magic number, but I've always found the "10% rule" to be a smart, effective starting point. As a general guideline, you should be ready to budget about 10% of your target profit for marketing on any given deal.

Think about it this way: if your goal is to pull $30,000 in profit from a flip, you should be comfortable investing around $3,000 to find and lock down that deal. This simple formula keeps your spending tied directly to your revenue goals, so you're not just throwing money at the wall hoping something sticks.

Now, that doesn't mean you need thousands to get started. Many of the most successful investors I know began with a much leaner budget—often under $1,000 a month. The trick is to focus that smaller budget on one or two laser-focused channels. A killer starting combo could be a direct mail campaign to a hyper-specific list (like probate or pre-foreclosure leads) paired with a small, tightly optimized Facebook ad campaign targeting your exact seller avatar.

The most important habit you can possibly build is to relentlessly track your Cost Per Lead (CPL) and, even more critically, your Cost Per Acquisition (CPA). Once you close a deal and see that return, you can confidently pour those profits back into the channels that are giving you predictable, repeatable results.

When you do this, your marketing stops being a speculative expense and becomes a calculated investment in your company's growth.

What's the Absolute Fastest Way to Get a Motivated Seller on the Phone?

If you want pure, unadulterated speed, paid digital advertising is almost impossible to top. A well-built Google Ads campaign can put your message directly in front of a motivated seller the exact second they're searching for a way out of their situation.

By targeting high-intent, "hand-raiser" phrases like "sell my house fast for cash" or "need to sell inherited property," you can have your phone ringing with qualified leads within 24 hours of launching. It's a direct line to people who are actively admitting they have a problem you can solve. That makes it an incredibly powerful tool for getting immediate deal flow.

But hold on—"fastest" doesn't always mean "best" or most profitable. For a strategy that combines speed with a near-zero upfront cost, old-school strategic networking is still king.

Let's look at two ways you could get a lead today:

Paid Ads: You could launch a targeted Google Ads campaign this morning and literally have a motivated seller on the phone by the afternoon.

Networking: You could have a 15-minute conversation with a divorce attorney or probate lawyer in your network and walk away with a high-quality, exclusive lead that very same day.

The smartest investors I know don't just pick one. They build a powerful engine by combining a fast-acting paid strategy for immediate results with the consistent, long-term networking and branding that creates a sustainable pipeline of deals for years to come.

Should I Buy Leads or Generate My Own?

This is the classic fork in the road every real estate investor hits, and your choice has massive implications for the future of your business. It really boils down to a choice between immediate convenience and long-term, sustainable brand equity.

Buying leads from a third-party service has one big thing going for it: instant volume. It's tempting, especially when you're just starting out or have your systems ready to handle a flood of prospects. You pay your money, and leads start showing up. Simple.

The massive, glaring downside? Those leads are almost never exclusive. That "hot lead" you just paid top dollar for was probably sold to four or five other hungry investors in your market. This means you're walking into a bidding war from the very first phone call, which hammers your potential profit margin and makes actually converting the deal a total dogfight.

Generating your own leads through your own marketing is definitely more work on the front end. You have to build a brand, craft offers that connect, and actually manage your own campaigns. But the strategic advantages are so huge they almost always lead to a higher ROI over the long haul.

Aspect | Buying Leads | Generating Your Own Leads |

|---|---|---|

Exclusivity | Almost never exclusive; you're in a race to the bottom. | 100% exclusive to you and your brand. |

Speed | Super fast; leads can start flowing in hours. | Slower to get going; requires setup and optimization. |

Cost | Can get very expensive, especially with high competition. | Often a much lower CPA over time as you dial it in. |

Brand Building | You're building the lead provider's brand, not yours. | You're building your brand as the go-to expert. |

Trust Factor | You're just another random person calling them. | They responded to your message, creating instant trust. |

When you generate your own leads, every single one is yours and yours alone. You've already started building trust through your unique brand message before you even say hello. This creates a much warmer conversation and a ridiculously higher chance of closing the deal. While buying leads can give you a short-term sugar rush, generating them builds a real, valuable, and far more profitable business.

At Wojo Media, we specialize in building omnipresent advertising campaigns that deliver a consistent flow of exclusive, high-intent leads for real estate investors. We bolt onto your business to refine your offers, build high-converting landing pages, and launch profitable ad campaigns across all major platforms.

Ready to stop fighting over stale leads and start generating your own? Book a free demo call today and get a custom paid ads strategy designed to scale your deal flow.

.png)

Comments